Governance Surveys

Online Article

No-Regret Moves for Boards in a Turbulent Proxy Season

Navigate the 2025 proxy season with key strategies to strengthen the company’s position with investors.

Various developments are driving uncertainty in the 2025 proxy season. Investor engagement on environmental, social and governance (ESG) topics may now be interpreted as an attempt to influence or control issuers under new US Securities and Exchange Commission (SEC) compliance and disclosure interpretations, which would trigger onerous reporting requirements for the investor. As a result, companies may find their largest institutional investors reticent to express perspectives, taking a listen-only approach to engagement or declining engagement altogether.

Some institutional investors are also revising their proxy voting policies on topics such as board diversity to remove bright-line standards and soften once-explicit expectations, making their voting intentions less clear. Additionally, new SEC staff guidance on shareholder proposals is expected to lower the burden for companies seeking to exclude environmental and social-related proposals. This change could alter the shareholder proposal landscape and drive activism in new, less predictable directions.

Companies should adapt to the intended and unintended consequences of these changes, which are still playing out as the 2025 proxy season progresses. In this dynamic environment, companies and their boards can make the following four moves to strengthen their positions with investors.

Make the case that the board is fit for purpose. Investors are paying closer attention to how director skill sets and experiences align with company-specific strategy and risks. In late 2024, the EY Center for Board Matters spoke with stewardship leaders from 47 institutional investors representing $55 trillion in assets under management. Forty percent of those investors highlighted board composition and effectiveness as one of their engagement priorities for 2025, more than three times the 13 percent that cited this topic the year before. At the same time, nearly half (47%) of the investors agreed that vote-no campaigns or the nomination of directors could become preferred approaches to drive change.

With this surge of investor focus on board quality and director accountability, companies should maximize all opportunities—whether through discussions or proxy statement disclosures—to highlight the effectiveness of their boards and tie director qualifications to each company’s strategy and its specific oversight needs.

Tell the company’s story on topics of investor focus. Investors and company management often work together to set agendas for engagement meetings, which serve as an opportunity for the company to understand investors’ areas of focus and related perspectives. As a result of the developments noted above, large institutional investors this year may rely on management to set the agenda for engagement meetings and may decline to share explicit expectations. Therefore, the onus will likely be on companies to anticipate and proactively address investors’ focus areas.

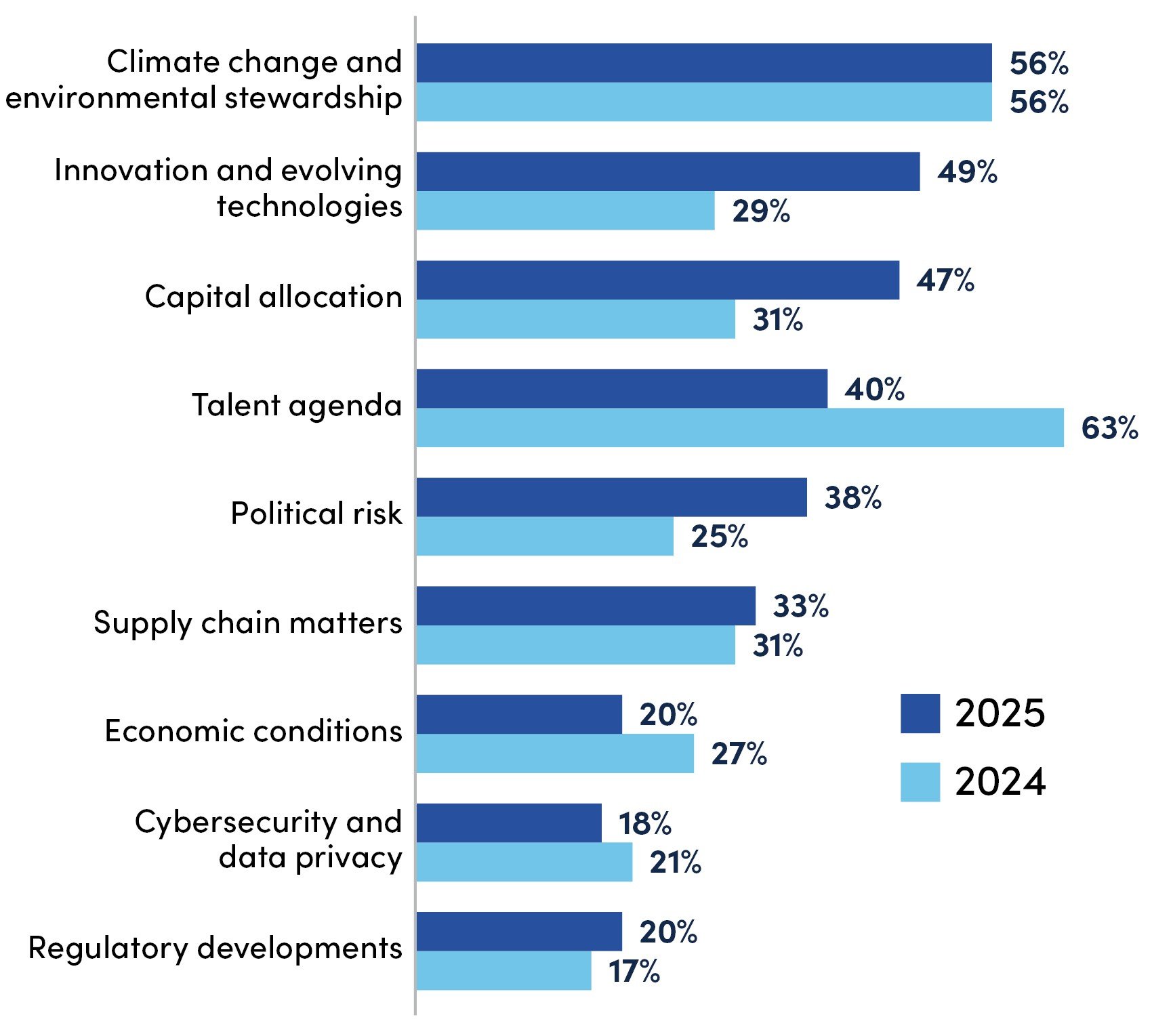

EY uncovered increasing investor attention to several key topics in 2025, including innovation and evolving technologies, capital allocation, and political risk. Investors’ interests for the coming year include how companies are investing in and governing artificial intelligence (AI), how capital strategy is driving long-term growth, and how companies are building resilience in the face of geopolitical risks. Boards can use these investor priorities to help frame discussions with top shareholders.

What Investors Want Companies to Prioritize in 2025

Source: Analysis by EY Center for Board Matters. Percentages represent the portion of investors who selected the topic as a top three priority.

Adapt engagement to the current environment. Companies may need to proactively raise engagement topics, including controversial ones, and expect that investors may leave some questions unasked. As a result, companies should plan to explain any changes they have made to disclosures, policies, and practices regarding sustainability and diversity, equity, and inclusion. Companies should review notes from previous discussions to refresh their understanding of specific investor views, in addition to reviewing investors’ disclosed policies and expectations. If there is a topic that investors have viewed as material in recent years, they are likely to have continued interest in how the company is addressing and making progress on that issue, even if they are less vocal about it.

Companies should also keep what they are hearing from smaller investors in perspective. Because those investors are less impacted by the new SEC guidance, their voices may grow louder, but their views are not necessarily aligned with those of large asset managers or other top shareholders.

Approach shareholder proposals through the lens of opportunity, as well as risk. A common refrain EY heard from investors is that the best shareholder proposals (i.e., those that are well targeted and that address investors’ informational needs) often never make it to a proxy ballot. That is because the companies and investors find common ground and reach agreement before these issues come to a vote. Under the SEC’s new guidance on shareholder proposals, fewer proposals are expected to survive no-action challenges, and there may be more attention given to those that do.

Companies should carefully consider the merit of proponents’ requests and respond appropriately. Knowing how proposal topics fared last year may be a helpful lens through which to view these requests. For example, across the S&P 1500, anti-ESG shareholder proposals garnered only 2 percent support on average in 2024. Companies should remember that investors weigh multiple company-specific factors, including the costs and potential risks for the company when implementing a proposal, in these voting decisions.

What Boards Can Ask

More proxy-related changes may be ahead as regulatory and policy developments continue to unfold, and as investors navigate a complex set of pressures from stakeholders. Below are questions board members can ask when navigating these pressures:

- Do company communications clarify the value each director brings? How do the board’s processes support regular refreshment and ongoing education in line with changing oversight needs?

- What story does the company tell stakeholders about its AI governance, capital strategy, and political risk management? Do investors have sufficient visibility into the board’s engagement with management on these matters?

- How is the company adapting its investor engagement program in the current environment? Does management provide sufficient clarity on recent changes in disclosures or policies and proactively address controversial topics as appropriate?

- How do the company’s governance practices align with those of peers and companies in the broader index? If there are areas where the company is out of step with market practices, how does it either address that disparity or communicate why it believes the chosen approach is right for the company and its shareholders?

The 2025 proxy season is marked by significant changes in investor engagement and proxy voting policies driven by ongoing regulatory and political developments. Companies can adapt to this shifting environment by highlighting board effectiveness, addressing key investor focus areas, and navigating shareholder proposals with a balanced approach to risk and opportunity.

The views reflected in this article are the views of the author and do not necessarily reflect the views of Ernst & Young LLP, other members of the global EY organization, or NACD.

The EY organization is a NACD sponsor, providing directors with critical and timely information, and perspectives. The EY organization is a financial supporter of the NACD.

Jamie Smith is a director with the EY Center for Board Matters at Ernst & Young LLP.