Governance Surveys

Directorship Magazine

We often speak about reputation risk as we would speak about the weather: it is ever-present and potentially bothersome, but manageable. Today, such complacency would be ill-advised.

Character assassination by angry stakeholders is now more than metaphorical. It is a sign of a cultural change that is making an alleged murderer into a widely hailed "folk hero" and transforming reputation risk from a corporate issue into a personal financial peril for corporate leaders that is not covered by directors and officers (D&O) liability insurance. For unmanageable, ungovernable, and uninsured reputation risks, prudent directors should demand coverage through captive insurance or a parametric insurance solution.

Reputation Risk Can Lead to Sudden Catastrophic Loss

Reputation value resides in stakeholder expectations. Reputation risk is the threat of losing that value from stakeholders who are usually emotionally charged when their expectations suddenly change, and they feel betrayed. Risk factors include unrealistic expectations, economic volatility, and political uncertainty.

Second only to the dumping of stock, a run on a bank is the purest expression of reputation risk. Two recent Nobel laureates explained decades ago how emotional shifts could flip expectations and trigger those runs. Similar flips in expectations can trigger boycotts, strikes, social license denial, regulatory opprobrium, and—most relevant to directors—calls for board refreshment. Anger from unmet expectations can engulf any company and its board.

While reputation risk forecasting is inexact, monitors of volatility in stakeholder expectations can improve reputation risk management and governance. This type of intelligence can augment the support most firms currently receive from investor relations, marketing, and specialized crisis communications professionals.

Reputation Risk Can Be Beyond Board Control and Oversight

Even in well-governed companies, outsized stakeholder expectations followed by idiosyncratic causes of disappointment can overwhelm risk management and communications efforts. The resulting reputation crises can leave board members personally exposed.

For example, faulted for a post–COVID-19 strategy of having “too much focus on financial and commercial goals and not enough attention on customers and staff,” departing Qantas Airways CEO Alan Joyce was penalized with a final payout that was shy $6.1 million, and the airline replaced its chair and several directors. At the Boeing Co., where management and 11 of the 13 board members from 2019 have departed, a post-mortem of its years-long reputation crisis may fault management and the board for paying insufficient attention to mission-critical issues such as safety and quality.

How Did Reputation Risk Invade the Boardroom?

Reputation risks are like bankruptcies: they come along gradually, and then all at once. Cultural changes in financial markets over the last decade, often termed stakeholder capitalism, slowly transformed broad, extra-financial issues, such as ethics, innovation, safety, security, sustainability, and quality, into personal reputation risks for corporate directors. The critical link is the movement’s central premise that stakeholders’ expectations had equal or superior standing to those of investors.

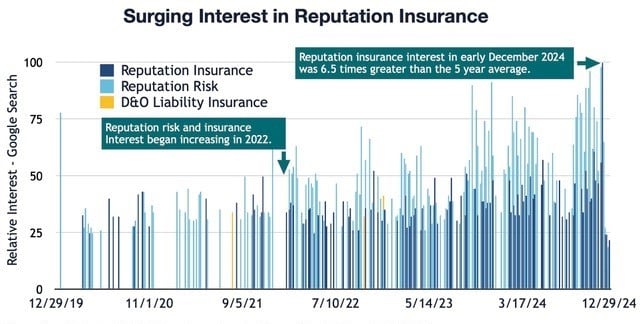

Source: Google Trends, US Web Search, 2019–2024. Queried Dec. 30, 2024.

Interest in reputation insurance is surging. A trend that surveys indicated starting after businesses committed to environmental, social, and governance (ESG) principles has been growing. Reputation insurance interest in early December 2024 was nearly seven times greater than the trailing five-year average.

Corporate reputation risk surged after 181 CEOs signed the Business Roundtable’s “Statement on the Purpose of a Corporation,” committing themselves to serving the interests of “all stakeholders,” especially communities, the environment, and investors. Communications professionals doubled down on promoting firms’ environmental, social, and governance (ESG) credentials to provide “reputation insurance.”

This has not panned out in our polarized world. Given a platform to voice their expectations, empowered stakeholders found that they could more easily vocalize their disappointment. Bond raters, equity analysts, and institutional investors, noticing that disappointed stakeholder actions could materially impair cash flow and equity value, became progressively more interested in both reputation risk governance and risk management, to the detriment of ESG credentials.

A more lasting consequence of this movement is that stakeholder capitalism expanded the professional scope of board oversight. Directors began overseeing responsible purchasing, diversity and human resources, and multiple regulatory constraints on privacy, security, and climate change.

In the penumbra of stakeholder capitalism, directors gradually fused their reputations with those of their firms. According to PwC’s 2020 Annual Corporate Directors Survey, 72 percent of directors reported that going through a recent reputational crisis reflected negatively on the board members themselves. Among directors aged 60 and younger, nearly four out of five expected to see “an impact on their personal brand.”

Personal Reputation Risk Loss Is Likely

Directors are vulnerable to the collective judgment of fellow board members, investors, and the court of public opinion. The standards for culpability differ from those used to adjudicate liability in a court of law. When deemed culpable in the court of public opinion, directors face potential future losses from public humiliation that may negatively impact board service compensation and future professional opportunities. Board clawback policies could be just over the horizon.

The likelihood has not gone unnoticed. According to experts, forestalling losses that might be triggered by peers’ decisions is why directors would like to defenestrate “troublesome” colleagues. In fact, 25 percent of directors would be happy about the departure of two or more peers, according to a recent PwC survey.

Institutional investors and proxy advisors explicitly disclosed under the heading of “systemic stewardship” that they expect firms to protect their reputation value. They underscored their seriousness by affirming their desire to punish CEOs for reputation damage through clawbacks. About one-third of S&P 500 companies now have clawback policies meeting these expectations.

The increased incidence and severity of personal reputation risk is why compensation consultants are recommending hazard duty pay for board leaders.

Directors Appreciate Reputation Insurance Options

The success of third-party D&O liability insurance and its limits of first-party coverage truthfully point to the pure and simple fact that board members now also need reputation risk insurance. It is a solution for reputation risk that two out of three directors surveyed at the 2022 NACD Summit preferred.

Alas, as Oscar Wilde ruefully observed in The Importance of Being Earnest, “The truth is rarely pure and never simple.” To acquire protection for this new exposure, directors will need to overcome managerial resistance and demand insurance options.

One option is to place a reputation risk policy with a firm’s captive insurer. Refinement options include fronting and reinsurance of the captive company’s risks. Both in the United States and in Europe, captives have been used to cover reputation risk since the early years of this century.

The other option available today is a separate parametric-type reputation insurance policy. It is an insurance strategy made possible by the structural similarities between natural and metaphorical catastrophes. This coincidence enables carriers to use parametric technology to provide reasonably priced coverage and both to front and reinsure captives.

The technology works the same way as Kelly’s Blue Book, which, based on a composite model of similar vehicles, provides near-instant, cost-of-loss estimates from which a carrier can calculate pricing. Because the capacity for this type of sophisticated solution is relatively limited, insureds will acquire the same bragging rights early adopters of D&O liability insurance once had. Strategically, they will look smart.

Returning to Normalcy with Reputation Risk Insurance

D&O liability insurance brought directors nearly four decades of personal protection for their service. Reputation insurance can extend this window, with one caveat: directors must first make clear to management that such coverage is a reasonable expectation for board service.

Nir Kossovsky is CEO and director of Steel City Re, a company that provides reputation metrics and reputation risk transfer solutions.