Governance Surveys

Center for Inclusive Governance

Most companies reach a point where performance stalls or the business does not get as many “wins” as it would like. During these periods, boards and management teams narrow their focus on refining the business strategy to overcome obstacles and achieve desired wins. An important concurrent step is aligning the company’s incentive strategy with the opportunities pursued.

One approach we have seen recently is to aim for a “home run” performance outcome, where the incentive strategy is structured to reward aggressive growth and shareholder returns. Our experience has shown that while some home run swings deliver outstanding results, many companies strike out. The consequences of a strikeout can include declines in shareholder value, collective disappointment from the board and management, increased turnover, and subsequent special actions needed to retain leaders, all of which can lead to say on pay challenges.

In other cases, pursuing a strategy of hitting a series of “singles” may enable more wins for the business through steady performance improvement. In these cases, the objective is to set and accomplish smaller, more attainable goals. When done well, hitting singles can drive steady shareholder value growth and create opportunities for management to achieve successful reward outcomes, leading to positive behavior loops and encouraging ongoing successes.

Evaluating Key Factors for Effective Performance Improvement Strategies

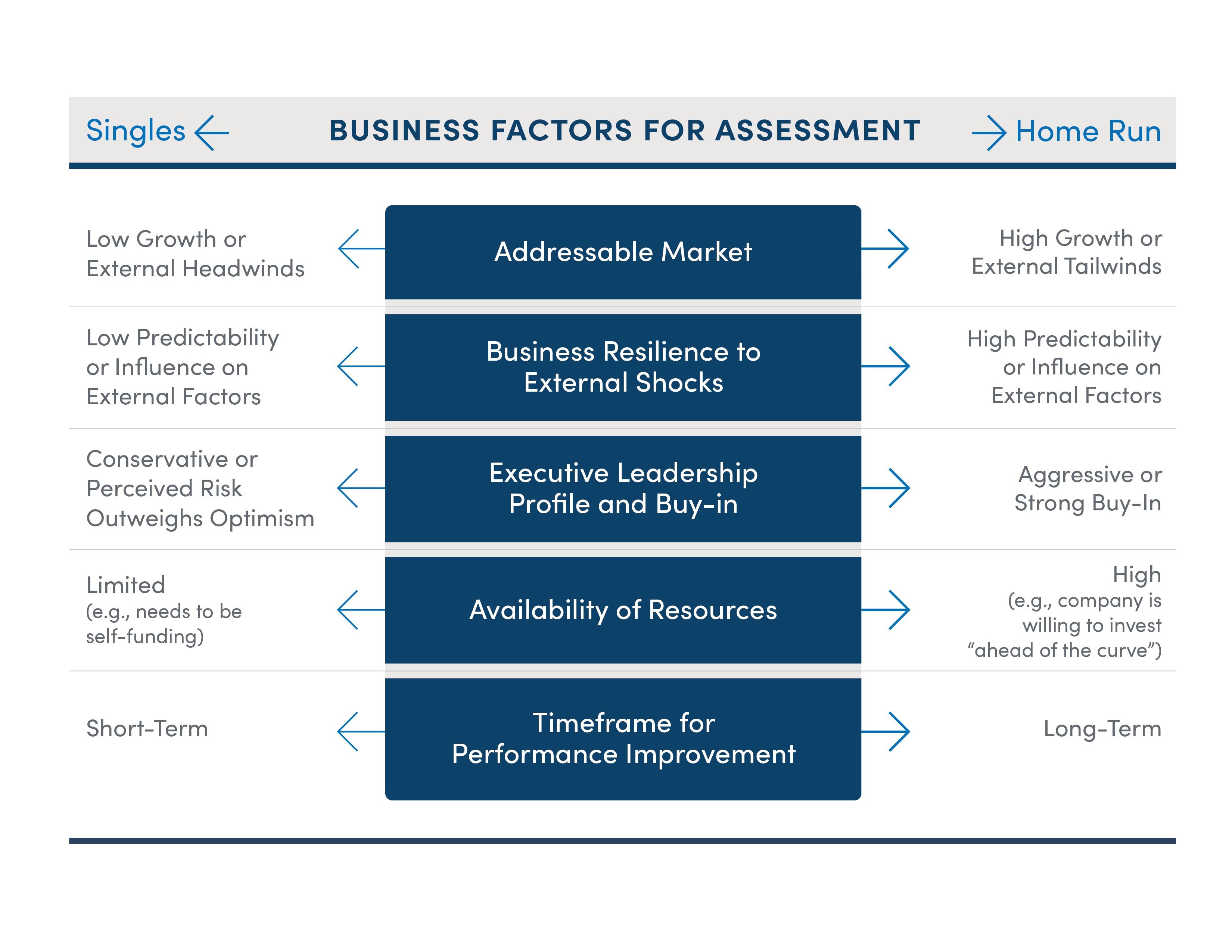

Several factors can clarify the preferred business and incentive approach to driving performance improvements. These include evaluating external business opportunities, which sets the stage for what performance objectives are truly viable. Other elements focus internally, requiring a thorough assessment of the company’s resources, urgency for change, leadership team profile, and the level of buy-in for performance improvements.

If the assessment yields more indicators of “singles” than a “home run,” incentives can still be highly effective in driving winning results, though the structure should be fine-tuned to reward the desired outcomes. A “singles” strategy may reflect principles such as seeking more predictability in business and incentive outcomes that can deliver steadier payouts with value accumulation over time.

If the assessment yields more indicators of a “home run” approach, it does not automatically imply that you should pursue the next big “moonshot” grant. Instead, the overall design strategy may use principles such as delivering outsized long-term payouts when outstanding performance is delivered (i.e., the home run) and calibrating goal-setting relative to award size to enable performance-driven outcomes.

| Dimension | “Singles” | “Home Run” |

| Risk Profile and Leverage | Low risk: achievable goals and limited upside, steady pay delivery. | High risk: aggressive goals and high upside, potentially volatile pay delivery. |

| Time Horizon | Short-term: drive near-term wins that add up to long-term success. | Long-term: support near-term results but drive to a mid- to long-term win. |

| Pay Mix (Cash versus Equity) |

Cash-focused: base or bonus makes up a higher percentage of overall pay. |

Equity-focused: Long-term incentives make up a higher percentage of realizable pay with performance. |

| Metrics |

Financial, operational, and potentially strategic: clearly defined objectives that management can drive and influence. Strategic goals can encourage progress when financials are less favorable. |

Financial and value-based: financial measures enable direct rewards for good versus outstanding outcomes. Share or market cap metrics create shareholder alignment. |

| Goal Setting |

Challenging but realistic: “must hit” baseline performance expectations, achievable targets, upside possible. |

Calibrate to enable strong upside: above-market target awards align with premium performance goals. More modest target awards can have achievable goals with strong value upside with performance. |

The decision to pursue a "singles" or "home run" approach should be based on a thorough assessment of external opportunities and internal resources. Both can be successful when seeking improved performance and more “wins.” Companies can effectively motivate their management teams and achieve their business goals by tailoring these principles to their specific circumstances and aligning management incentives with the intended strategy to reinforce the desired business outcomes.

Semler Brossy is a NACD partner, providing directors with critical and timely information, and perspectives. Semler Brossy is a financial supporter of the NACD.

Brant Shelor is a managing director at Semler Brossy.

Cody Hervert is a senior consultant at Semler Brossy.